Effective Forex Swing Trading Strategies for Success

In the dynamic world of trading, swing trading has emerged as a popular and strategic approach to capitalizing on market movements. For forex traders, swing trading strategies can offer an exceptional way to leverage price fluctuations over a period of days to weeks. In this article, we will dive deep into swing trading strategies tailored for the forex market, providing insights that could help traders enhance their profitability. Additionally, learning to navigate forex swing trading strategies Pakistani Trading Platforms can further diversify your trading experience and opportunities.

Understanding Swing Trading

Swing trading is a strategy that focuses on capturing short to medium-term price movements in financial markets. Unlike day trading, which involves executing multiple trades within a single day, swing trading allows traders to hold onto positions for several days or weeks. This approach is particularly well-suited for forex trading because of the inherent volatility and liquidity present in currency pairs.

Key Principles of Swing Trading

To successfully engage in swing trading, traders need to adhere to a few fundamental principles:

- Market Timing: Recognizing the right time to enter and exit trades is crucial for maximizing swing trading profits.

- Technical Analysis: Utilizing charts and indicators to predict price movements is an essential aspect of swing trading.

- Risk Management: Setting stop-loss orders and managing position sizes are vital for protecting capital.

Popular Swing Trading Strategies for Forex Traders

Here are several effective swing trading strategies that can be employed in the forex market:

1. Moving Average Crossovers

This strategy involves using two moving averages—a short-term and a long-term—to identify potential price reversals. When the short-term moving average crosses above the long-term moving average, it signals a potential buying opportunity. Conversely, when it crosses below, it suggests a selling opportunity. Traders often use different time frames, such as the 50-day and 200-day moving averages, to generate signals.

2. Fibonacci Retracement Levels

Fibonacci retracement levels are used to identify potential reversal points in the market. These levels, derived from the Fibonacci sequence, provide traders with insights into possible support and resistance levels. Swing traders often enter positions around these levels, expecting price movements to continue in the direction of the overall trend.

3. Support and Resistance Ranges

Identifying key support and resistance levels is critical for swing trading. By recognizing these levels, traders can pinpoint entry and exit points for their trades. When price approaches support, it may present a buying opportunity, while resistance could suggest a selling opportunity.

4. Momentum Trading

Momentum trading involves capitalizing on the strength of price trends. By analyzing momentum indicators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), traders can gauge whether a currency pair is overbought or oversold. This analysis helps in making informed trading decisions based on prevailing market strength.

Developing a Trading Plan

A robust trading plan is essential for any swing trader. Here are some key components of an effective trading plan:

- Trading Goals: Define clear, measurable goals that you want to achieve with swing trading.

- Market Research: Conduct thorough research to understand the currency pairs you wish to trade, including their behavior and underlying factors influencing price movements.

- Entry and Exit Criteria: Establish criteria for entering and exiting trades, along with your preferred indicators to help you make these decisions.

- Risk Management Strategies: Determine how much capital you are willing to risk on each trade and set appropriate stop-loss levels.

The Importance of Risk Management

Risk management is a cornerstone of successful trading. Here are some strategies to consider:

- Setting Stop-Loss Orders: Always use stop-loss orders to limit potential losses on trades. A good rule of thumb is to risk no more than 1-2% of your trading capital on any single trade.

- Diversifying Currency Pairs: Avoid putting all your capital into one currency pair. Diversification can mitigate risk by spreading exposure across various pairs.

- Position Sizing: Calculate appropriate position sizes based on your risk tolerance and account size, ensuring you do not overextend yourself on any trade.

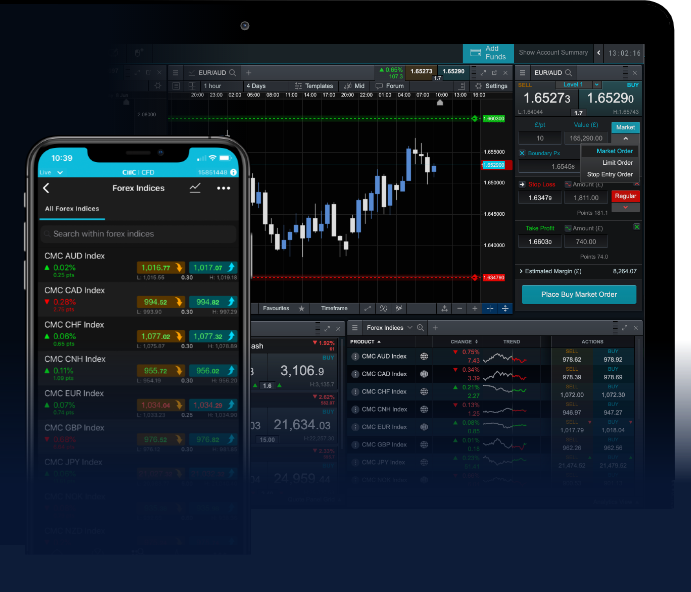

Leveraging Technology for Swing Trading

With advancements in technology, traders can access various tools that enhance their swing trading strategies. Forex trading platforms provide features such as:

- Advanced Charting Tools: Many platforms offer customizable charting tools with technical indicators, making it easier for traders to conduct analysis.

- Automated Trading: Some traders utilize algorithmic trading systems that can execute trades based on predefined criteria, removing emotional decision-making.

- Market News and Analysis: Access to real-time news and analysis can help traders remain informed about events that might impact currency markets.

Staying Informed and Adapting Strategies

The forex market is constantly evolving due to socio-economic factors, geopolitical events, and changes in monetary policies. Successful swing traders must stay updated on global economic indicators and news that can influence currency movements. Regularly reviewing and adapting trading strategies based on these developments is crucial for long-term success.

Conclusion

Swing trading in the forex market provides an exciting opportunity for traders to capitalize on price movements while maintaining a balanced approach to trading. By understanding the principles behind swing trading, employing effective strategies, and focusing on risk management, traders can position themselves for success. Remember, the journey of a trader requires continuous learning and adaptation. Therefore, always be open to refining your strategies and expanding your knowledge base.